Margin Of Safety Book Price

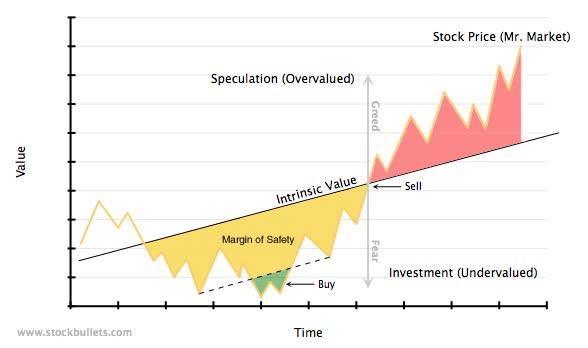

That means looking at the downside before looking at the upside. So in the starting period its at a 15 discount then later only 10 5 and eventually is at fair value.

Margin Of Safety Risk Averse Value Investing Strategies For The Thoughtful Investor By Seth A Klarman 1991 Hardcover For Sale Online Ebay

Free delivery on qualified orders.

Margin of safety book price. The key insight for most value investors is the all investments must have an inherent margin of safety. So the price increases from 2295 to 44. In 1991 when Seth Klarman was 34 years old he published Margin of Safety with the publisher HarperCollins.

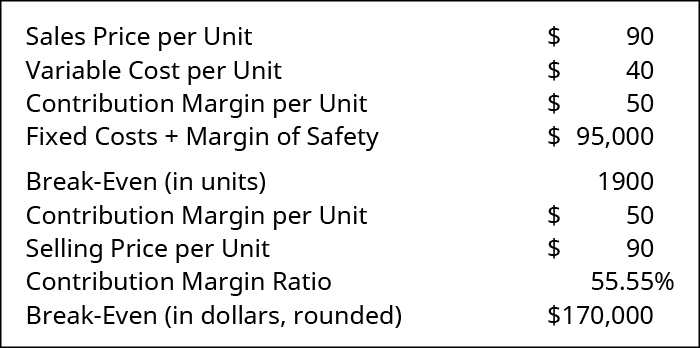

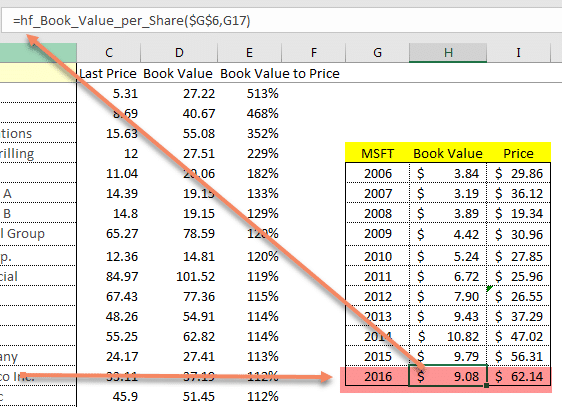

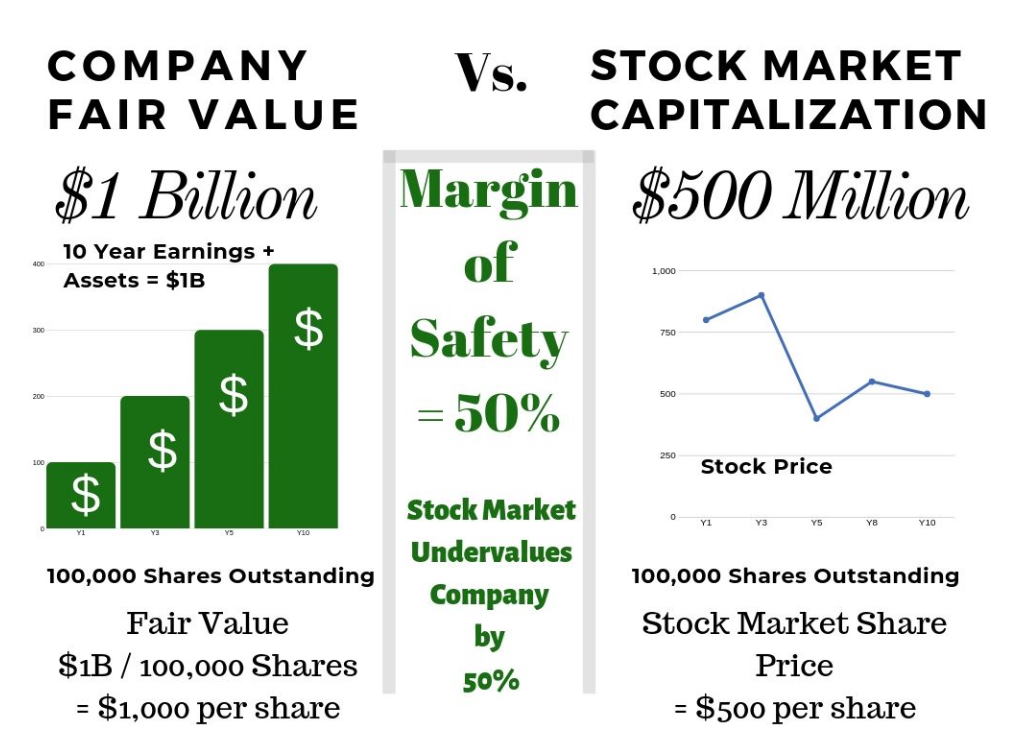

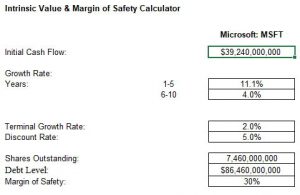

How to Calculate the Margin of Safety. Risk-Averse Value Investing Strategies for the Thoughtful Investor 9780887305108. Here are two alternative versions of the margin of safety.

The book initially sold just 5000 copies for 25 a piece and it was considered a flop. Margin of safety. The book is in three parts.

For any security it will be large at one price small at some higher price nonexistent at some still higher price How can investors be certain of achieving a margin of safety. According to Graham The margin of safety is always dependent on the price paid. So the margin of sales percentage tells us that Minnesota Kayak Company can sell 44 fewer dollars worth of kayaks and still.

Current Sales Level Breakeven Point Current Sales Level Margin of safety. Intrinsic value is the actual worth of a companys asset or the present value of an asset when adding up the total discounted future income generated. Remember that the market price of a share may not.

Margin of safety is a principle of investing in which an investor only purchases securities when their market price is significantly below their intrinsic value. While Margin of Safety is the title of the book it refers to an aspect of the stock market. Read Margin of Safety.

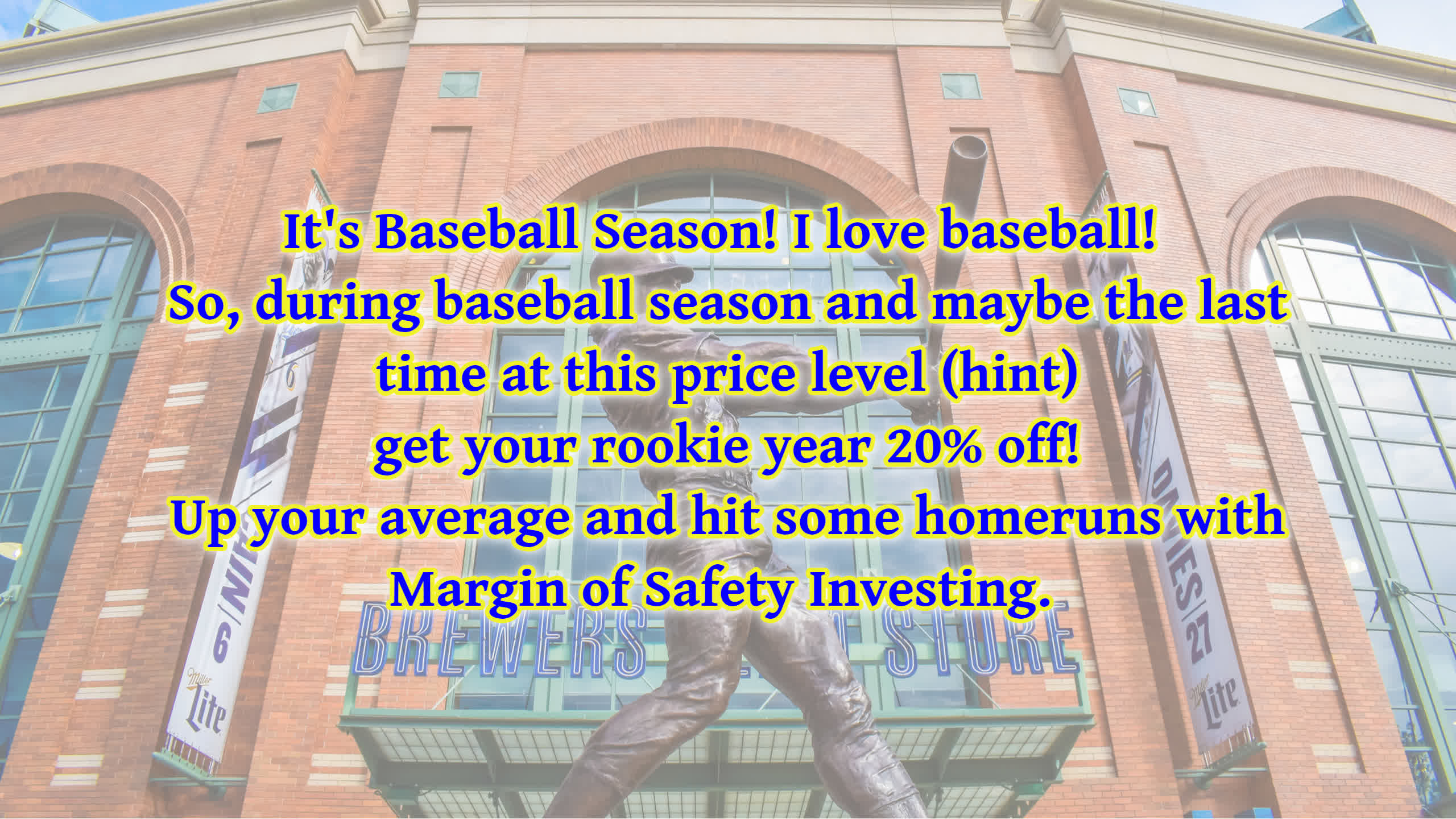

The difference between the market price and the book value is the margin of safety. Margin of Safety is a famous phrase coined by Ben Graham half a century ago and taken up by Seth Klarman here as a full volume. Simply put it is the difference between the intrinsic value of a stock and its market price It also refers to how far a business sales can fall before breaking even.

Amazonin - Buy Margin of Safety. To calculate the margin of safety subtract the current breakeven point from sales and divide by sales. Well now we look for the margin of safety.

It tells us the margin of safety price is 2500 dollars thats one half of the sticker price so make a note that the margin of safety price is 50 percent discount to the real value of the business. Is their margin of safety percentage. When we bought shares of Constellation Software I dont remember how much we paid but we paid a reasonable valuation I think 18 or.

Over this ten year period lets say the price of the stock gradually increases back up to fair value as the market sees this company continue to perform well. Let us assume that the book value per share of a company is 10 but the market price of one share is 20. The amount of this buffer is expressed as a percentage.

The margin of safety is not just in the price you pay its also in the quality of the business its in the balance sheet of the business and the accounting and also in terms of the quality of top management. Risk-Averse Value Investing Strategies for the Thoughtful Investor book reviews author details and more at Amazonin. In the principle of investing the margin of safety is the difference between the intrinsic value of a stock against its prevailing market price.

A company may want to project its margin of safety. We can check our calculations by multiplying the margin of safety percentage of 44 by actual sales of 25000 and we end up with 11000. MARGIN OF SAFETY Risk-Averse Value Investing Strategies for the Thoughtful Investor Seth A.

What is their margin of safety percentage. This 1991 book is an investing classic so much so that it sells for 780 on the secondary market. Klarman HarperBusiness A Division of Harper Colllins Publishers.

Risk-Averse Value Investing Strategies for the Thoughtful Investor book online at best prices in India on Amazonin. In other words when the market.

Margin Of Safety Risk Averse Value Investing Strategies For The Thoughtful Investor By Seth A Klarman

Margin Of Safety Risk Averse Value Investing Strategies For The Thoughtful Investor By Seth A Klarman 1991 Hardcover For Sale Online Ebay

Calculate And Interpret A Company S Margin Of Safety And Operating Leverage Principles Of Accounting Volume 2 Managerial Accounting

Margin Of Safety Risk Averse Value Investing Strategies For The Thoughtful Investor By Seth A Klarman 1991 Hardcover For Sale Online Ebay

Margin Of Safety Risk Averse Value Investing Strategies For The Thoughtful Investor By Seth A Klarman

Margin Of Safety Investing Marketplace Checkout Seeking Alpha

How To Use A Margin Of Safety When Investing Dividend Monk

Margin Of Safety Analysis Of Stocks With Formula In Excel With Marketxls

Why Margin Of Safety Is Misunderstood And Not Used Enough Old School Value

Margin Of Safety Risk Averse Value Investing Strategies For The Thoughtful Investor By Seth A Klarman 1991 Hardcover For Sale Online Ebay

Margin Of Safety Buffett Graham S Magic Formula Explained

Margin Of Safety Risk Averse Value Investing Strategies For The Thoughtful Investor By Seth A Klarman

Intrinsic Value And Its Relationship To Margin Of Safety Arbor Asset Allocation Model Portfolio Aaamp Value Blog

Margin Of Safety Buffett Graham S Magic Formula Explained

Margin Of Safety Risk Averse Value Investing Strategies For The Thoughtful Investor By Seth A Klarman

Margin Of Safety Risk Averse Value Investing Strategies For The Thoughtful Investor By Seth A Klarman 1991 Hardcover For Sale Online Ebay

Value Investing 101 In 2021 Value Investing Investing Investing Books

Margin Of Safety Risk Averse Value Investing Strategies For The Thoughtful Investor By Seth A Klarman 1991 Hardcover For Sale Online Ebay

Modern Value Investing 25 Tools To Invest With A Margin Of Safety In Today S Financial Environment By Sven Carlin

Post a Comment for "Margin Of Safety Book Price"